Agentic AI Takes Root in Zimbabwe: Automating Finance in a Complex Economy

A silent revolution is taking root in Zimbabwe's financial technology landscape, driven not by simple automation, but by a new breed of artificial intelligence: Agentic AI. This advanced paradigm, where AI systems are granted autonomy to plan, execute, and adapt multi-step tasks, is being actively piloted to solve some of the nation's most persistent economic and operational challenges. From navigating stringent foreign exchange regulations to extending credit in the informal sector, autonomous agents are moving beyond theory into tangible, efficiency-driving applications.

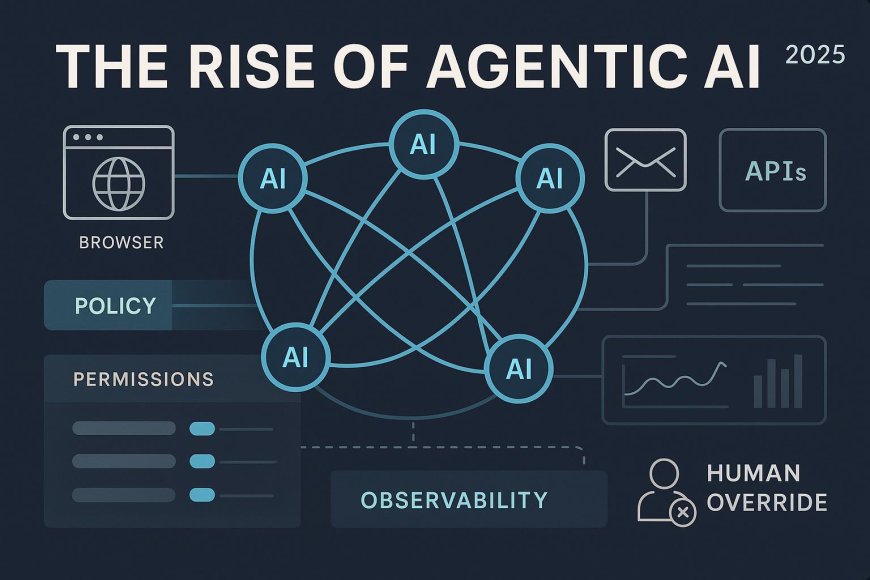

The shift represents a fundamental upgrade from the first wave of AI in African fintech. While chatbots and basic analytics tools react to user input, Agentic AI is proactive. It is deployed with a strategic goal—such as "secure the best possible forex rate for this importer within regulatory bounds" or "underwrite a nanoloan for a market trader using alternative data." The agent then independently breaks this goal down into a sequence of actions: accessing real-time data, performing calculations, submitting forms to digital government gateways, and negotiating terms across platforms, all while learning from the outcomes to refine its future approach.

In Zimbabwe's unique economic context, characterized by a multi-currency system and a large informal economy, three concrete use cases are emerging as primary proving grounds for this technology.

1. Autonomous Regulatory Compliance and Forex Acquisition

For small and medium-sized enterprises (SMEs), procuring foreign currency for imports is a time-consuming and bureaucratic process. Agentic AI systems are now being tested to manage this entire workflow autonomously. An agent can be tasked by a business owner with sourcing USD $5,000 for raw materials. The agent will then:

-

Continuously monitor multiple authorized forex trading platforms and rates.

-

Prepare and pre-populate the necessary regulatory documentation (e.g., CD1 forms for the Reserve Bank of Zimbabwe).

-

Execute the trade once a pre-set optimal rate is achieved.

-

Log the transaction and update the company's accounting software.

This end-to-end automation converts a process that often takes days of manual effort into a background operation completed in hours, allowing business owners to focus on core operations rather than financial logistics.

2. Hyperlocal, Data-Driven Agricultural Microlending

The agricultural sector, the backbone of the economy, remains high-risk for lenders due to climate volatility. Agentic AI is enabling a new model of dynamic, asset-backed lending. An AI agent deployed by an agri-fintech company can be assigned to evaluate and service a smallholder farmer. Its autonomous functions include:

-

Continuous Risk Assessment: Ingesting and analyzing real-time satellite imagery for field health, localized weather forecasts, and soil moisture data.

-

Dynamic Loan Structuring: Using this analysis to adjust the terms, disbursement schedule, or insurance bundling of a short-term input loan in real-time.

-

Automatic Collateral Management: Monitoring the growth stage of the crop (the loan's collateral) via satellite and triggering alerts or negotiations if the perceived risk exceeds a threshold.

This creates a responsive financial product that traditional banking infrastructure cannot offer, linking credit directly to real-world asset performance.

3. Orchestration of Multi-Platform Financial Services for the Informal Sector

A significant portion of economic activity occurs in the informal sector, where individuals use a fragmented mix of mobile money, cash, and digital platforms. Agentic AI is being explored as a personal financial orchestrator. A user could instruct an agent to "save $10 for school fees by month-end." The agent would then:

-

Analyze the user's transaction history across EcoCash, OneMoney, and bank SMS alerts (with consent).

-

Create a micro-savings plan, perhaps rounding up transactions and moving small amounts to a locked savings product.

-

Identify small, non-essential spending patterns and suggest reallocations.

-

Provide a unified financial view and execute automated, incremental savings transfers.

This turns the agent into a proactive financial custodian, promoting inclusion by integrating disparate financial footprints into a coherent, goal-oriented plan.

Foundations and Hurdles

The architecture enabling these use cases relies on two core technologies: Large Language Models (LLMs) for complex reasoning and decision-making, and Retrieval-Augmented Generation (RAG). RAG is critical, as it allows agents to access and act upon the latest regulatory circulars, market prices, and policy documents, ensuring decisions are based on current, verified facts rather than outdated training data.

However, the path to widespread deployment is not without obstacles. The computational infrastructure required for persistent, always-on agents is costly. A profound skills gap exists in designing, securing, and maintaining these autonomous systems. Perhaps most critically, the regulatory framework for non-human agents making financial decisions—including liability for errors—is virtually non-existent, requiring proactive dialogue between innovators and regulators.

Strategic Imperative

For Zimbabwe's fintech sector, the investment in Agentic AI is a strategic necessity, not just a technological experiment. In an economy where manual processes create friction and uncertainty, the ability to automate complex, multi-step financial and regulatory tasks delivers a direct competitive advantage in speed, cost, and reliability. The early pilots in forex, agriculture, and personal finance demonstrate a clear trajectory: Agentic AI is poised to become the next critical layer of infrastructure, enabling Zimbabwe's digital economy to operate with a new level of intelligence and resilience.

Francis

Francis