YouTube’ Monetizes: Restricts Offline Content Download to Premium

YouTube’s decision to restrict offline downloads to Premium subscribers is more than a consumer inconvenience—it’s a strategic monetization play that reflects broader trends in digital content economics. At its core, this policy highlights the tension between user expectations of “free internet” and platforms’ need to generate sustainable revenue. In fintech terms, YouTube is leveraging scarcity and access control as a subscription driver, while simultaneously protecting its advertising ecosystem and licensing obligations.

Premium as the Monetization Engine

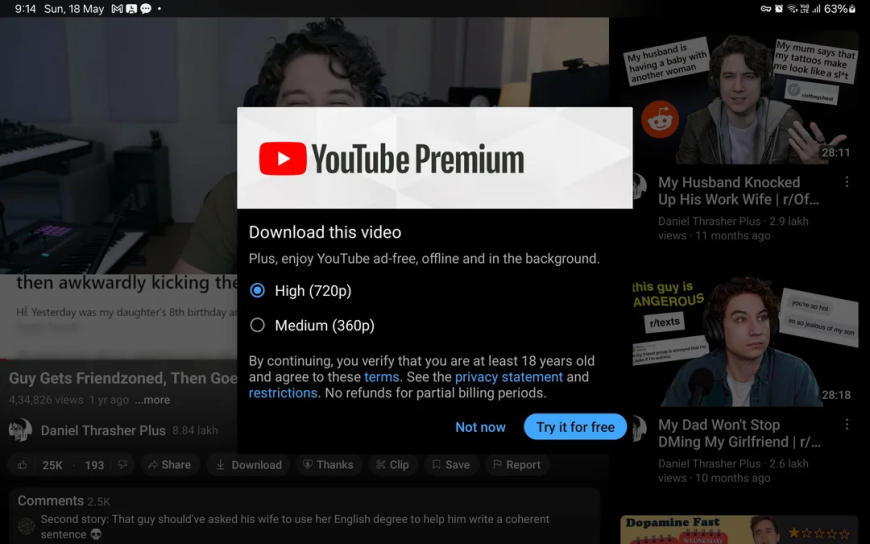

YouTube Premium, priced at approximately $13.99 per month, is the official gateway to offline downloads.

Mechanics: Downloads are encrypted, playable only within the YouTube app, and require periodic internet verification.

Limitations: No permanent MP4 files, exclusions for certain licensed content (notably music videos), and regional restrictions on quality.

Value Proposition: Premium subscribers enjoy ad-free viewing, background play, and higher-quality downloads (up to 1080p).

From a fintech lens, this is a classic bundling strategy: offline downloads are not sold as a standalone feature but packaged with other perks to justify the subscription fee. The encryption model ensures that downloads remain tethered to YouTube’s ecosystem, preventing leakage into piracy channels.

Free Offline Access: A Controlled Experiment

In late 2025, YouTube began testing limited free downloads in select regions.

Scope: Low-quality (144p–360p) downloads, excluding music videos.

Target Markets: Emerging economies with unreliable connectivity, where offline access could boost retention.

Strategic Implication: This is a loss-leader experiment—offering minimal offline functionality to entice users toward Premium while reducing churn in bandwidth-constrained geographies.

For fintech observers, this resembles a freemium model stress test. By offering a degraded version of the premium feature, YouTube gauges elasticity: how much quality degradation users will tolerate before upgrading.

Third-Party Downloaders: The Shadow Market

Despite YouTube’s restrictions, a thriving ecosystem of third-party downloaders exists. Tools like 4K Video Downloader promise permanent MP4 files, often in high resolution.

Risks: Malware exposure, copyright infringement, and violation of YouTube’s Terms of Service.

YouTube’s Response: Technical blocks, legal takedowns, and continuous API adjustments.

Market Insight: The persistence of these tools demonstrates latent demand for offline access outside YouTube’s sanctioned channels.

From a fintech perspective, this is a grey-market arbitrage: users exploit loopholes to access features without paying, while YouTube expends resources to enforce compliance. The dynamic mirrors financial markets where shadow banking thrives despite regulatory crackdowns.

Why Offline Downloads Are Restricted

YouTube’s policy is rooted in economic and legal imperatives:

Revenue Protection

Premium subscriptions are a growing revenue stream. Free downloads would cannibalize this model.

Copyright Compliance

Permanent MP4 downloads would breach licensing agreements with music labels and studios.

Advertising Economics

Offline viewing bypasses ads, undermining YouTube’s primary revenue source for free users.

Engagement Metrics

Requiring periodic internet checks ensures users remain active in YouTube’s ecosystem, feeding recommendation algorithms and data analytics.

This is a textbook case of platform economics: balancing user utility with monetization and compliance.

Regional Strategy: Emerging Market Playbook

YouTube’s limited free-download trials in 2025 highlight a geo-strategic approach.

In bandwidth-constrained regions, low-quality offline access reduces churn.

In mature markets, Premium remains the primary monetization lever.

This bifurcation reflects a tiered pricing strategy common in fintech: maximize willingness to pay in affluent regions while offering stripped-down features in emerging markets to capture volume.

Competitive Benchmarking

YouTube’s stance aligns with broader industry trends:

Platform Offline Downloads Restrictions

Netflix Yes (subscription) Content varies by license

Spotify Yes (Premium only) Offline playback limited to app

TikTok Limited (Save Video) Watermarked, shareable only

YouTube Premium only (mostly) Encrypted, app-only, excludes some videos

The fintech insight here: offline access is monetized as scarcity. Platforms increasingly treat downloads not as a default feature but as a premium commodity.

Technical Architecture: Why MP4 Isn’t Allowed

YouTube’s encrypted offline files are a deliberate design choice. Allowing MP4 downloads would:

Enable redistribution without ads.

Break licensing agreements.

Undermine YouTube’s control over playback environments.

Encryption ensures ecosystem lock-in, a principle familiar in fintech where closed systems (e.g., digital wallets) prevent leakage of value.

User Sentiment and Market Backlash

Despite YouTube’s rationale, user frustration is palpable. Complaints include:

Quality limits for free downloads.

Exclusion of music videos.

Dependency on Premium subscriptions.

Workarounds via third-party tools remain popular, underscoring a demand-supply mismatch. In fintech terms, this is a customer experience gap—users perceive value in offline access that YouTube has chosen to monetize aggressively.

Future Outlook

Several scenarios could unfold:

Expanded Free Downloads

Broader rollout of low-quality offline access in emerging markets.

Tiered Premium Models

Cheaper plans offering limited offline functionality.

Creator-Controlled Downloads

Allowing creators to opt-in for free downloads, balancing rights with accessibility.

Enhanced Enforcement

Continued crackdowns on third-party downloaders, tightening the compliance perimeter.

For fintech strategists, the key takeaway is that offline access is a monetization frontier, not a free utility.

Conclusion

YouTube’s offline download policy is a microcosm of digital platform economics. By restricting downloads to Premium subscribers, YouTube monetizes convenience while safeguarding revenue streams and licensing obligations. Free users face sharp limitations, and third-party tools remain a risky workaround.

In fintech terms, this is a scarcity-driven subscription model: offline access is no longer a default feature but a monetized privilege. The broader lesson for digital platforms is clear—control over access, not just content, is the new battleground for monetization.

Francis

Francis