Zimbabwe's New Digital Tax Sparks Concerns for Tech Startups

Zimbabwe's government has introduced a 15% Digital Services Withholding Tax (DSWT) on payments made to foreign digital service providers, effective January 1, 2026. This move aims to capture revenue from the growing digital economy, but it's raising concerns among tech startups and industry experts.

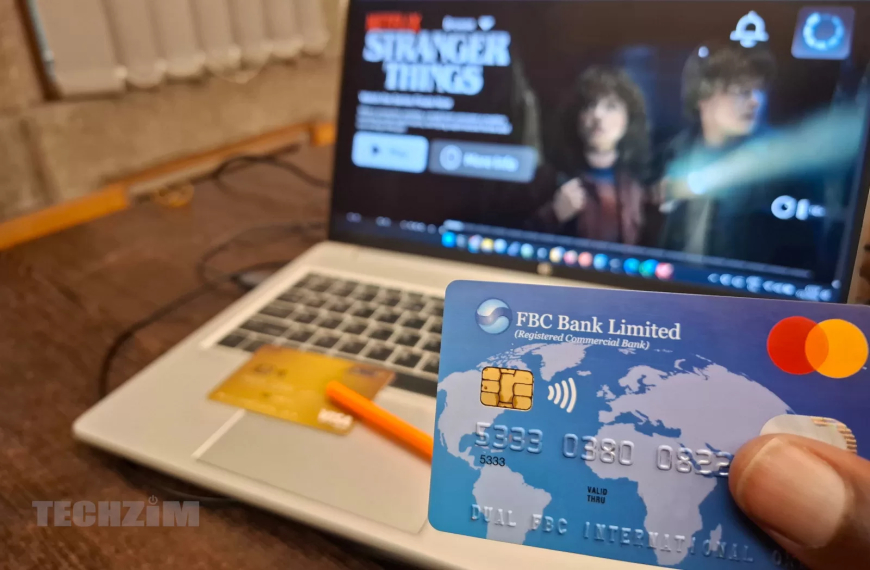

The tax targets services like streaming platforms, ride-hailing apps, and satellite internet providers, including global giants like Netflix, Spotify, and Starlink. Local financial institutions will withhold the tax at the point of payment, shifting the compliance burden to businesses and individuals.

Impact on Tech Startups

The digital tax is expected to increase costs for tech startups, potentially hindering their growth and competitiveness. The tax will directly feed into higher prices... and the cost of doing business, which is what we don't want, especially when we're on the road to promote digitalisation.

Local tech startups may face unfair competition from foreign platforms that previously avoided taxation. The tax also raises concerns about double taxation, as some services already charge VAT.

Government's Perspective

Finance Minister Mthuli Ncube defends the tax, citing the need for fairness and modernization of revenue collection. "The digital economy has grown faster than our tax rules could keep up with, and now we're closing that gap," Ncube said.

Industry Reactions

The banking sector warns of operational challenges and potential avoidance behaviors. The tax will increase the cost of doing business and accessing services, encourage avoidance through diaspora-based payments and cash transactions, and push users away from formal banking channels.

As Zimbabwe joins other African countries implementing digital taxes, the impact on its tech startup ecosystem remains uncertain. While the government aims to boost revenue, the tax's effectiveness and potential consequences for digital growth are being closely watched.

Francis

Francis